How to Earn from Amazon Without Being an Amazon Seller

What if you could earn money from Amazon without selling any of your own products on the marketplace? That’s right. You can make money by acquiring an affiliate business. If you have marketing and SEO skills, you can leverage your knowledge on building a content site and monetize it through Amazon Associates.

There are tons of other ways to earn from your content via display advertising and other affiliate offers.

But for this post, we will focus on the Amazon Associates Program alone, and how you can leverage upfront capital to acquire an affiliate business making money.

Is Amazon Associates A Good Way to Earn Side Income?

Amazon Associates is a very popular business model for those looking to create a side source of income, as these businesses are most often front-loaded.

This means that most of the sweat equity required to get the business up and running will be required at the very beginning. Here’s how you can do it:

- Once you have started generating income through your content and ranking for profitable keywords, you will most likely move on to outsourcing your content production.

- With operational systems in place, things start to really ease up on the workload, which means you now have a fairly passive stream of cash flow.

- Many of those, still new to the online business space, are unaware that you can purchase an Amazon Associates business already generating cash and skip the entire startup process.

- The best thing about this option, over building something from the ground up, is that you know you have a winning operation that is already generating money.

- If you happen to be one of those few who still don’t know how anyone can make money from Amazon without selling a physical product, we will first explain how you can do that with the Amazon Associates Program.

How to Sell on Amazon Without Having an Amazon Store

Amazon Associates is like any other affiliate program on the market today.

You simply place trackable links within your written or visual content, and anytime someone clicks on your link and makes a purchase on Amazon, you earn a commission.

This event takes place over and over until you eventually start seeing a steady source of income without ever having to sell a single product of your own.

For this reason, many people choose to build massive content networks to spread their revenue sources.

If you’re not familiar with e-commerce or even how to source, produce, and distribute a product of your own, this is a great opportunity to make money from Amazon without needing to sell an individual item. Before we dive deeper into how you can scale and manage a content network of your own, we should cover how these businesses are valued.

How an Affiliate Business is Valued

There are several factors that come into play when determining the value of an Amazon Associates content site.

For starters, there’s the new update to commissions that Amazon pays their associates depending on the specific category of products you are sending traffic to. A few other factors that we will cover in further detail include the brand’s social following, any assets like an email list or push notification subscriber list, and others.

The breakdown of how a content site is valued on a basic level is:

The first part of the above equation is quite easy to get. The second part, however, will often stump most.

Multiples for any type of online business can have wild ranges, from a 20x monthly net profit all the way up to 80x+.

It makes sense when you take into account how different each business is, even if they’re operating in the same business model or even within the same niche!

One of the most important parts to understanding is what actually goes into creating the multiple parts of this equation.

Certain factors like how old the domain name is and how diverse your traffic sources are will also play a role in determining what monthly multiple an Amazon Associates business will receive.

Here are a few considerations that come into play when determining what typical multiple a business will receive when compared to other similar assets being acquired and sold on the market:

1. Pricing Windows

As you may have noticed in the valuation image above, we used a 12-month average to show you what the gold standard is for determining the most accurate value of the business.

Some business owners wanting to exit a business without this much data may suffer a hit on their valuation multiple in doing so. Buyers who are looking to acquire these types of businesses also like to see how potential seasonality may affect the income they will receive once they take over the business.

Submitting your business for sale on the market with only three to six months of revenue data may also work out in the favor of some, as you may be able to bargain in favor of the assets’ growth potential.

This approach may often be better suited for those with experience in the space and who have a fundamental understanding of SEO and content ranking techniques.

Because there is such a long time gap needed to get these types of businesses up and running when compared to selling a physical product outright, the age of the business will also swing in the favor of increasing your multiple.

2. Domain Age

Google looks at domain age as a basic ranking factor for trustworthiness, so as such, the age of your business domain will also move the multiple needle.

Studies have shown that Google will often rank a domain with a longer history over a newer site, which Amazon determines to still be in the ‘Sandbox’ phase.

Once your domain has some time on the web, you may find that you begin to rank better for keywords related to your target market.

3. Traffic Diversity

As previously mentioned, if you are looking to purchase an Amazon content site for serious cash, you want to make sure that not all of your eggs are in one basket.

If you only have one marketing channel that is driving a majority of your revenue, you are putting the entire business in jeopardy should this source of traffic stop, along with all the revenue it was bringing in.

Having social media profiles for your business, even if you are simply reviewing other people’s products, is still valuable in the eyes of Google.

When you have other sources of traffic liking and sharing links to your content, you build trust in the eyes of the search engine results page (SERP) in that your content is getting outside attention. It’s also a chance for you to partner with influencers to extend your brand’s reach.

Email marketing is another huge bonus in the eyes of any potential investor looking to acquire an Amazon Associates content business, as this provides another stream of potential income should the owner not be familiar with how to perform this operation themselves.

Outside of traffic diversity and utilizing more than one form of marketing to your audience, your content itself may play a role in moving the multiple needle as well.

4. Article Content

The content a business is publishing to gain the attention of its target audience is also important in determining the value of the business.

Perhaps just 10 years ago you could get away with spammy links to anything and everything under the sun and figure out a way to monetize it, but things have changed drastically since then.

Not only should the content on your site be as optimized as possible with all of today’s SEO techniques, but you should also be focusing on reader intent and expertise, authoritativeness, and trustworthiness (EAT).

Interlinking content within your own site is also something that most business buyers will look at when deciding what type of price range they would consider investing in. On-site page interlinking is something many SEO professionals have used to spread traffic naturally and should be used in your content site as well.

If all of this just sounds like way more work than you are willing to put into a side source of income, you may want to consider bypassing the hard stuff and get straight into finding a business already optimized to be passive for any new owner.

Finding the Right Deal

Because every Amazon Associates business has its own unique characteristics, you should first have a clear understanding of what your specific budget and criteria are.

- Are you the type of individual that can dedicate 10–20 hours per week running this business, producing the content, and managing links and SEO on your own?

- Or would you rather have a managerial position where you delegate outsourced VAs to handle the daily operations for you in order to focus on scaling through marketing and keyword research?

Depending on your specific business and personal goals, you may find that one growth opportunity in a potential acquisition fits your current skill set more than another.

The biggest struggle we see new investors make is biting off more than they can chew by taking over a business model they have no prior experience in. If you can determine what you are really good at and find a business lacking in this area of expertise, usually you can outsource the operations you need some extra help with.

Most online business buyers will fall within six buyer personas we have created, which are based on these unique differences, and when and what an individual buyer may acquire based on their personal and business goals.

No matter what your specific reason for acquiring digital property may be, one thing is the same for everyone, and that is performing the tedious task of due diligence prior to reaching out and making an offer to the seller.

A Due Diligence List

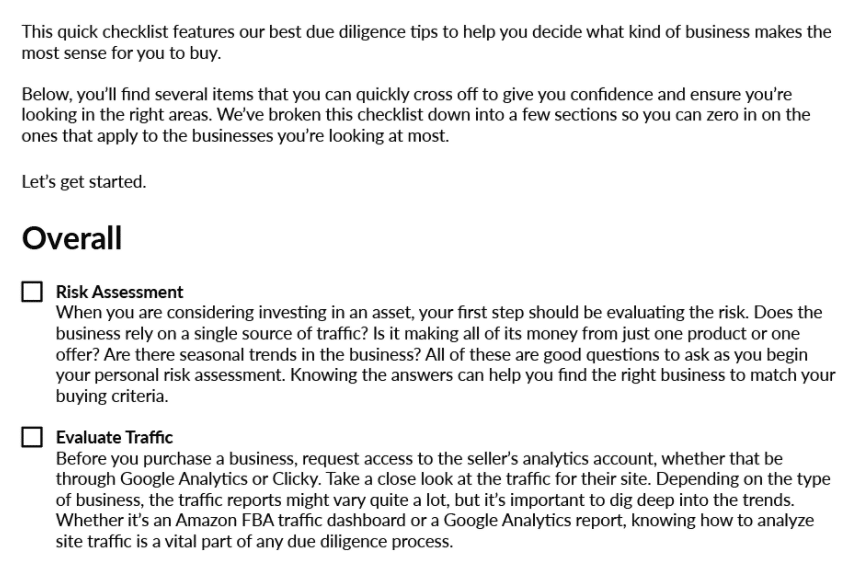

Due diligence is an advanced research operation on a potential investment opportunity.

Most commonly, buyers will have a checklist that they use to perform a quick five-minute scan on whether a business is worth further investigation to then qualify as a potential investment opportunity.

Image Source: Empire Flippers

Further, digging during due diligence then takes place in the form of looking over a few factors of the business we have already covered in this post. Things such as :

- How many hours the business owner currently spends maintaining the business

- Where the traffic is coming from, how spread across multiple sources traffic (and revenue) is

- Which keywords the site is ranking for, and whether these offer long-term potential or simply a trend in that moment

The due diligence process is different for everyone, but the basis remains the same in that buyers will make their own personal determination during the process on whether they see the business as worth their time to explore further.

One thing many business owners have told us they look for is why a business owner is selling their asset and what future plans they have in growing and scaling within their industry.

This brings up an important topic on planning your exit and having a strategy on how to market your business as a winner on the rise and not a trend that is slowly breathing its last breath.

How to Prepare for an Amazon Associates Business

When it comes to preparing for an acquisition of your own, there is little you need to do if you have a little help on your side.

Buyers just need to create an Amazon Associates account, and once that is done, start transferring tracking IDs from the seller to buyer, updating any personal accounts or information, and making sure that the revenue is now directed to your bank account prior to releasing your funds to the seller.

If the content site uses Product Advertising (API) to reflect real-time market value, you’ll need to swap APIs as well.

This can be a little more complicated, which is why we recommended a broker to help you if it’s your first deal.

Often, when you use a broker to help you migrate the business, they will provide a safety net to make sure the income is going into your bank account prior to releasing any funds or the business itself to the buyer should an issue occur during the deal.

How do I Make Sure Revenue/Traffic Doesn’t Drop?

We will cover four ways you can avoid any sudden drops in traffic or revenue for a newly acquired business:

- One of the first steps is to see if you can work in a performance-based deal structure should the seller be open to this. Buyers will often try to work this into a deal as much as possible as it limits their risk of having a deal that will only get paid should the business meet a certain criterion in revenue or net profit earnings.

- Another way to avoid a sudden dip once you take full ownership is to see if the seller is willing to provide some type of added support post-sale. This could mean many things to many people depending on who you ask, but the gist is to get help with the business after the deal is done should any unforeseen issues arise.

- Also, you can have a basic understanding of the core skills the business requires to maintain its course.

- The fourth (but not the last) way to avoid sudden dips in any of your important metrics is to study and understand the niche you are getting into. From first account discussions with sellers looking to exit their content site, a majority of these owners often get burned out in the niche they have been in for a year or more at the time of listing their business.

Having an understanding of the niche and a growth strategy based on current optics of interest within the community may uncover hidden growth opportunities the current owner may not be staying on top of.

It is also important that you are interested in the niche of the site that you are looking to acquire.

Where do I Find Great Deals?

When scouring the internet for potential online businesses to acquire, you will find you have a few options to choose from.

For some with a bit of skin in the game already, this might be as easy as reaching out to their network and gauging if anyone has a business they are looking to exit from. This could be a simple listing on a Facebook page or a friend they met at an SEO business conference a few years back.

Private deals may seem like a great opportunity for a buyer (which some can be); however, the seller is missing out in this process unless they stick to their guns in demanding more than the buyer thinks it may be worth.

This is where using a broker is a great option for both parties as the seller gets what they want, and the buyer has a better opportunity at performing a simple earn-out deal structure or perhaps the option for owner financing, which may become troublesome for private acquisitions.

Private Acquisition: Tips for Sellers

A few tips we have when performing a private acquisition for sellers is to never sell too low.

This means you should have a reputable valuation performed on your business in comparison to what the market has determined other buyers are acquiring for. This can be extremely difficult when it comes to a private deal, but remember in doing so you are settling for the buyers’ best offer based on their opinion.

Another great mention for sellers is to divorce from emotional equity.

Which in turn is great for buyers as now they will not be spending countless hours trying to meet you in the middle on something you truly don’t want to part ways with.

Whether you decide to optimize an email list, scale the social media profiles, or perform conversion rate optimization on a well-aged content site, using the techniques we discussed in this post will ensure your future success within Amazon’s ecosphere without ever having to sell a single product, ever.

Author Bio

Branden is part of the marketing team at Empire Flippers. Originally from Los Angeles, California, he’s spent the last decade traveling around the West Coast and different parts of Asia. After his service in the US Navy, he started his online career listening to the Empire Flippers podcast and has taken the skills he learned over the years to build a foundation in his digital journey. If you are ready to take the next step in acquiring the next investment opportunity in your digital portfolio, be sure to register for your free Empire Flippers account. Every Monday, we release brand new content sites that have the foundation you need to scale to new heights.

The post How to Earn from Amazon Without Being an Amazon Seller appeared first on AMZ Advisers.